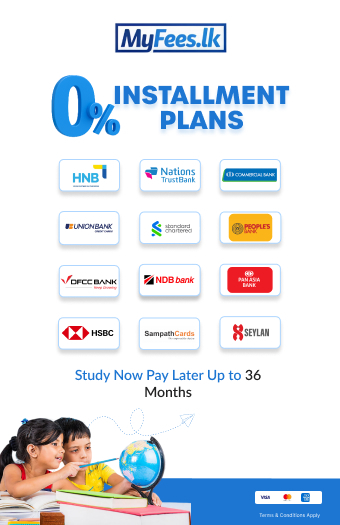

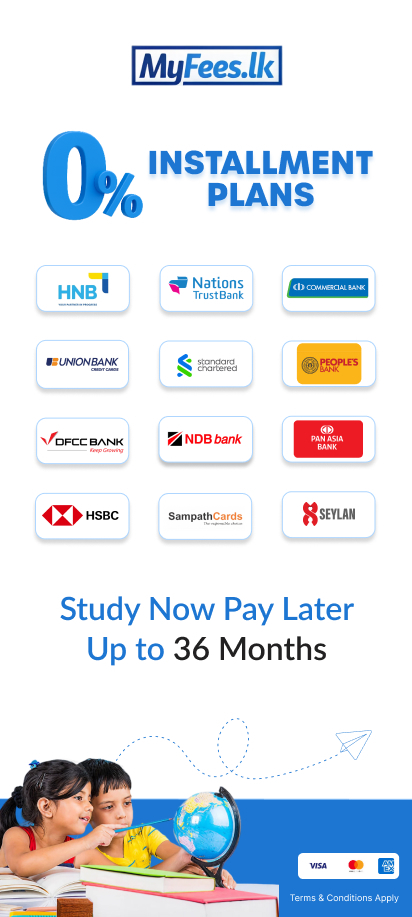

Study Now, Pay Later !

Easy payment plans for your education payments

24 Months

12 Months

24 Months

12 Months

12 Months

12 Months

24 Months

12 Months

36 Months

60 Months

12 Months

24 Months

|

Bank |

6 Months |

12 Months |

24 Months |

36 Months |

|---|---|---|---|---|

|

|

|

|

- |

|

|

|

- | - |

|

|

|

|

- |

|

|

|

- | - |

|

|

|

- | - |

|

- |  |

- | - |

|

|

|

|

- |

|

|

|

- | - |

|

- |  |

|

|

|

- |  |

|

|

|

- |  |

- | - |

|

- |  |

|

- |

For HNB Credit Cardholders

| Installment Tenure | Handling Fee |

|---|---|

| 3 Months | 0% |

| 6 Months | 0% |

| 12 Months | 0% |

| 24 Months | 0% |

Validity Period - 31st January 2026

Minimum Txn Value - 10,000

Maximum Txn Value - 1 Million

Minimum Txn Value - 10,000 | Maximum Txn Value - 1 Million

Transaction Coversion Window

30 Days

How to covert your transaction

Call 0112 462 462

- To convert to an Installment Plan, Call 0112 462 462 within 5 calendar days of performing the transaction and make sure to mention that the payment was made via the payment portal MyFees.lk (Owned and operated by Convenienza Solutions (Pvt) Ltd).

Terms & conditions

*Terms and conditions apply

For Commercial Bank Credit Cardholders

| Installment Tenure | Handling Fee |

|---|---|

| 6 Months | 2.5% |

| 12 Months | 3% |

Validity Period - 31st January 2026

Minimum Txn Value - 20,000

Minimum Txn Value - 20,000

Transaction Coversion Window

7 Days

How to covert your transaction

Call 011 2 353 353

- Mention that the payment was made via the payment portal MyFees.lk (Owned and operated by Convenienza Solutions (Pvt) Ltd).

- General Credit card Terms and Conditions apply.

- The Bank reserves the right to modify or change the Terms and Conditions applicable for the offer.

Terms & conditions

*Terms and conditions apply

For HSBC Bank Credit Cardholder

| Installment Tenure | Processing Fee | Handling Fees |

|---|---|---|

| 6 Months | 4% | 2,500 |

| 12 Months | 0% | 2,500 |

| 24 Months | 15% | 2,500 |

Validity Period - 31st December 2025

Minimum Txn Value - 50,000

Maximum Txn Value - 600,000

Minimum Txn Value - 50,000 | Maximum Txn Value - 600,000

Transaction Coversion Window

30 Days

How to covert your transaction

www.hsbc.lk/flexi- Utility bill payments made through HSBC internet banking service, cash advances, installment transactions, Casino transactions, fees and charges shall not be eligible for this Promotion.

- Customers beyond the maximum number of transaction conversion times, will not be entertained given the risk appetite of the bank.

Terms & conditions

*Terms and conditions apply

For AMEX Credit Cardholders

| Installment Tenure | Handling Fee | Processing Fee |

|---|---|---|

| 6 Months | 0% | 1,500 |

| 12 Months | 0% | 1,500 |

Validity Period - 31st January 2026

Minimum Txn Value - 50,000

Maximum Txn Value - 600,000

Minimum Txn Value - 50,000 | Maximum Txn Value - 600,000

Transaction Coversion Window

30 Days

How to covert your transaction

Call 0114 414 141

- Promotion eligibility is only on one-time transactions. (Transactions cannot be split and combined in order to convert in to ESP)

- The offer is valid for payment done on MyFees.lk only

- Primary cardholder and supplementary card accounts will be considered as one account

- General credit card terms and conditions will continue to apply.

- Applicable card types -

- Amex Centurion Platinum

- SLA Co-Brand Platinum

- Amex Explorer Card

Terms & conditions

For BOC Credit Cardholders

| EPP Tenure | Handling Fee |

|---|---|

| 3 Months | 4.0% |

| 6 Months | 6.5% |

| 9 Months | 8.0% |

| 12 Months | 10.0% |

| 18 Months | 15.0% |

| 24 Months | 18.0% |

Validity Period - 31st August 2025

Minimum Txn Value - 50,000

Maximum Txn Value - 600,000

Minimum Txn Value - 50,000 | Maximum Txn Value - 600,000

Transaction Coversion Window

30 Days

How to covert your transaction

www.hsbc.lk/flexi

- Installment Plans for payments made on MyFees.lk are valid until the 30th of April 2024.

- The cardholder should fill the attached application form included in the link below. Download Form

- Application should be forwarded to Bank of Ceylon card center within 7 days of the transaction using the below mentioned methods:

- Option 1 – Email to boccard@boc.lk

- Option 2 - Hand over the application to the nearest BOC branch and ask them to forward to BOC card Centre.

- Option 3 - FAX 011- 2389129

- The transaction value should be over 25,000/-

- Acceptance of this application and the installment amount and period granted shall be at the sole discretion of the bank.

- In the event of their application not being accepted by the bank, the whole of the installment plan amount referred to above shall be debit to the same card account.

Terms & conditions

*Terms and conditions apply

For Seylan Bank Credit Cardholder

| Installment Tenure | Minimum Txn Value | Maximum Txn Value | Processing Fee | Handling Fee (One time) |

|---|---|---|---|---|

| Upto 12 Months | 10,000 | 1,000,000 | 0% | 0 |

Validity Period - 30th June 2026

Transaction Coversion Window

7 Days

How to covert your transaction

Call 011 2000 8888

- Click to convert your payment

- The Bank reserves the right to change the above rates at any time appropriately.

- In the event an early settlement of the payment plan is required, the cardholder can do so by settling the remaining installment amount to the credit card and the upfront handling fee which was charged at the time of the transaction conversion will not be refunded back under any circumstances.

Terms & conditions

*Terms and conditions apply

For Union Bank Credit Cardholders

| Installment Tenure | Processing Fee | Handling Fee | TXN Thr Type | Card Type |

|---|---|---|---|---|

| 3 Months | 0% | N/A | 50000 | All Card Types |

| 6 Months | 0% | 990 | 50000 | All Card Types |

| 12 Months | 0% | 1900 | 50,000 - 100,000 | All Card Types |

| 12 Months | 0% | 2400 | Above 100,000 | All Card Types |

| Installment Tenure | Processing Fee | Handling Fee | TXN Thr Type | Card Type |

|---|---|---|---|---|

| 18 Months | 0% | 2900 | 50,000 | Platinum & Signature Cards |

| 24 Months | 0% | 3900 | 100,000 - 250,000 | Platinum & Signature Cards |

| 24 Months | 0% | 5400 | Above 100,000 | Platinum & Signature Cards |

Validity Period - 31st December 2025

Transaction Coversion Window

14 Days

How to covert your transaction

Call 0115 800 800

- Promotion eligibility is only on one-time transactions. (Transactions cannot be split and combined in order to convert in to ESP)

- The offer is valid for online & POS transactions

- Primary cardholder and supplementary card accounts will be considered as one account

- One card member is entitled to convert maximum of five (5) transactions at a single merchant establishment for the entire promotion period.

- General credit card terms and conditions will continue to apply.

Terms & conditions

For DFCC Bank Credit Cardholders

| Installment Tenure | Processing Fee | Handling Fee |

|---|---|---|

| 6 Months | 0% | RS. 2500 |

| 12 Months | 0% | RS. 2500 |

Validity Period - 31st January 2026

Minimum Txn Value - 25,000

Maximum Txn Value - 1,000,000

Minimum Txn Value - 25,000 | Maximum Txn Value - 1,000,000

Transaction Coversion Window

7 Days

How to covert your transaction

Call 0112 350 000

- The promotion is open to all Credit Cards issued by DFCC Bank (corporate cards excluded).

- In order to convert a transaction to an Easy Payment Plan, the cardholder should call the 24 hour Contact Centre on 0112350000 within 05 days of performing the transaction. All transactions that are performed and processed to the card 5 days prior to the statement date will be converted to an Easy Payment Plan during the next statement period. In such instances, the cardholder will be required to settle the total outstanding amount on the statement on which the transaction (s) that are to be converted have been billed. The Easy Payment Plan will come into effect only during the next statement period. The cardholder will be liable to pay all fees and interest applicable for nonpayment of the prior statement balance.

- Customers can convert the transaction only within the credit card limit.

- DFCC Bank accepts no liability for the quality of goods and services provided by the services establishments involved in this promotion.

- Easy Payment Plan conversion will not be valid for Cash Advances, transactions performed for Commercial purposes, transactions performed on behalf of 3rd parties, card being used by other than the cardholder and card has been pre-funded to process the transaction.

- DFCC Bank reserves the right to withdraw, modify or change all or any of the rules, Terms & Conditions applicable to this promotion at any given time without prior notice.

- If any dispute arises regarding any of the Terms and Conditions contained herewith, the decision of the respective service establishment and DFCC Bank shall be final.

- The cardholder may perform single/ Multiple transactions in order to convert the transaction for EPP, Provided a single transaction to be Rs. 25,000 – Rs. 1,000,000.

- The general Credit Card terms and conditions will continue to apply.

Terms & conditions

For NDB Bank Credit Cardholders

- Installment Plans available up to 36 months till the 31st December 2025.

| Installment Tenure | Processing Fee | Handling Fee |

|---|---|---|

| 12 Months | 0% per Month | +1500 |

| 24 Months | 0% per Month | +2500 or 1% |

| 36 Months | 0% per Month | +2500 or 1% |

Validity Period - 31st January 2026

Minimum Txn Value - 100,000

Maximum Txn Value - 2,000,000

Minimum Txn Value - 25,000 | Maximum Txn Value - 2,000,000

Transaction Coversion Window

7 Working Days

How to covert your transaction

Call 0117 44 88 88

- For transactions, Rs. 25,000 – Rs. 100,000 can be converted up to 12 months 0% installment plans only.

- Customers are required to call 0117 44 88 88 within 7 days, to convert their payment to an Installment Plan.

- For more information, Visit http://www.ndbbank.com/

Terms & conditions

*Terms and conditions apply

For People's Bank Credit Cardholders

| Installment Tenure | Processing Fee | Handling Fee |

|---|---|---|

| 3 Months | 0% | N/A |

| 6 Months | 0% | N/A |

| 12 Months | 0% | N/A |

| 18 Months | 0% | N/A |

| 24 Months | 0% | N/A |

| 30 Months | 0% | N/A |

| 36 Months | 0% | N/A |

| 48 Months | 0% | 6000 |

| 60 Months | 0% | 7500 |

Validity Period - 31st January 2026

Transaction Coversion Window

7 Working Days

How to covert your transaction

Call 1961

- The promotion is open to all Credit Cards issued by People’s Bank.

- Customers can convert transactions within the Credit Card Limit.

- People’s Bank accepts no liability for the quality of goods and services purchased during the promotional period.

- If any dispute arises regarding any of the Terms and Conditions contained herein, the decision of the Bank shall be final.

- The Bank reserves the right to modify or change all or any of the rules applicable to this Promotion and/or features of this Promotion at any time and also reserves the right to extend or shorten the duration of the Promotion and/or withdraw or cancel the Promotion at any time without prior notice.

- The promotion is bound by the terms & conditions of the People’s Bank and the service establishment.

- General terms and conditions pertaining to Credit Cards of the Bank will continue to apply

Terms & conditions

*Terms and conditions apply

For Standard Chartered Credit Cardholders

| Installment Tenure | Processing Fee | Handeling Fee |

|---|---|---|

| Up to 12 | 0% | N/A |

Validity Period - 31st October 2025

Minimum Txn Value - 50,000

Minimum Txn Value - 50,000

Transaction Coversion Window

7 Working Days

How to covert your transaction

Call 011 2 480 480

- This offer is valid only for holders of Standard Chartered credit cards issued in Sri Lanka.

- This offer is only valid for purchases done through MyFees.lk.

- This offer cannot be used in conjunction with other offers/promotions available at MyFees.lk.

- Standard Chartered will not accept any liability in respect of the goods and services provided by the merchant and for any non-adherence to health & safety guidelines by the merchant.

- Standard Chartered reserves the right to amend/withdraw this offer at its sole discretion with prior notice.

- Neither Standard Chartered nor the merchant accepts any liability for the consequences arising out of interruption/disruption of its business or services by or on account of but not limited to acts of God, pandemics, riots, civil commotion, insurrections, wars, strikes or lockouts or for any reason beyond their control.

- If any dispute arises, the decision of Standard Chartered and MyFees.lk will be considered as final.

Terms & conditions

*Other general credit card Terms & Conditions will continue to apply.

For Sampath Bank Credit Cardholders

| Installment Tenure | Processing Fee | Handling Fee |

|---|---|---|

| 12 months | 0% | N/A |

Validity Period - 31st December 2025

Minimum Txn Value - 25,000

Maximum Txn Value - 2,000,000

Minimum Txn Value - 25,000 | Maximum Txn Value - 2,000,000

Transaction Coversion Window

30 Days

How to covert your transaction

Call 1332

- Eligible cards include all Sampath Mastercard Credit, Visa Credit, Sampath Bank American Express® Credit Cards (excluding Corporate Cards).

Terms & conditions

For more information: https://www.sampath.lk/sampath-cards/credit-card-offer/1388

*Terms and conditions apply

For Pan Asia Bank Cardholders

| Installment Tenure | Processing Fee | Handling Fee |

|---|---|---|

| 12 & 24 Months | < 250,000 | 2,500/- |

| 12 & 24 Months | 250,000 – 500,000 | 5,000/- |

| 12 & 24 Months | 500,000 – 750,000 | 7,500/- |

| 12 & 24 Months | 750,000 – 1,000,000 | 10,000/- |

Validity Period - 31st December 2025

Minimum Txn Value - 25,000

Maximum Txn Value - 1,000,000

Minimum Txn Value - 25,000 | Maximum Txn Value - 1,000,000

Transaction Coversion Window

7 Days

How to covert your transaction

Call 0114 667 222

- Make sure to mention that the payment was made via the payment portal MyFees.lk (owned and operated by Convenienza Solutions (Pvt) Ltd).

- General credit card terms and conditions will continue to apply.

- The Bank reserves the right to modify or change the Terms and Conditions applicable for the offer.

Terms & Conditions